Volworks Launches AI-Powered Option Position Management Solution (OPMS™)

- The Volworks Team

- Sep 14, 2025

- 2 min read

September 15th, 2025 - Chicago, IL

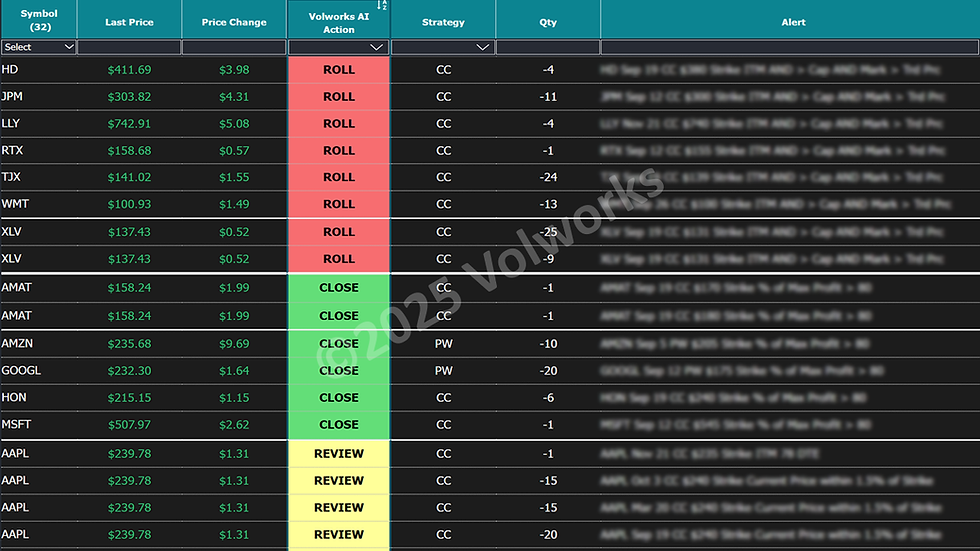

Volworks, an AI-driven wealthtech and advisory firm, today announced the release of its game-changing Option Position Management Solution (OPMS™), the first AI-powered platform explicitly designed to manage options strategy positions rather than isolated trades. Integrated into the broader Volworks next-generation, options-focused platform, OPMS™ extends the firm’s mission to help advisors and institutions implement and actively manage option strategies across portfolios.

Designed for advisors, family offices, and institutional investors, OPMS sets a new standard in active position and risk management, providing real-time strategy metrics, AI-Action Alerts™ with optimized roll recommendations, and full custodian integration for seamless data connectivity.

“Before we developed OPMS, I relied on a patchwork of online trading platforms and Excel spreadsheets to manage positions. It was inefficient, left gaps in risk oversight, and wasn’t scalable. I realized that if I had these problems, other experienced option traders managing overlay strategies for clients faced the same challenges. That’s when we knew a custom, scalable solution was the only way forward.” — Victor Viner, Founder & CEO, Volworks.

A New Approach to Options Management

Unlike traditional execution systems, OPMS focuses on strategy management after trades are placed. The platform generates AI-Action Alerts for every position, guiding users with one of four clear recommendations:

Do Nothing

Review

Close

Roll

If a roll is advised, OPMS automatically selects the optimal expiration and strike based on each investor’s objectives and their personal Risk, Return, & Regret® profile.

Real-Time Risk Oversight and AI-Action Alerts

Recognizing that option risks are often underestimated or misunderstood, OPMS was built to keep all stakeholders informed—not just traders. In an industry first, the system distributes scheduled risk alert reports five times daily:

One Hour Before the Open

30 Minutes After the Open

Midday (1:00 p.m. ET)

One Hour Before the Close

20 Minutes After the Close

These reports ensure that risk managers, compliance officers, and senior leadership remain aware of exposures across client portfolios in real time, reducing blind spots that have historically led to unmanaged risks, lawsuits, and regulatory fines.

Additional Highlights

Proprietary AI-Action Alerts integrated into all reports and dashboards

Custodian connectivity via APIs and daily files

Customizable dashboards with daily PnL, sector benchmarking, and unique option strategy visualizations

Monthly premium and income tracking across covered calls, put writes, and iron condors

Tracking Yield Across Income Strategies

OPMS also tracks realized and unrealized short premiums across covered calls, put writes, iron condors, and other income strategies—with monthly premium and income breakdowns for added transparency. This enables advisors and institutions to measure the actual contribution of options overlays through clear, client-ready reports.

A Unified Model: Technology + Expertise

OPMS is part of the broader Volworks Platform, which combines AI-driven analytics, strategy modeling, hedging and overlay reports, and real-time position management with institutional-grade advisory services. By pairing Next-Gen technology with human expertise, Volworks delivers an integrated model that empowers professionals to integrate options with confidence, discipline, and consistency.

About Volworks

Volworks is a Chicago-based wealthtech and advisory firm transforming how RIAs, family offices, and institutions integrate options into portfolios. The Volworks Platform combines AI-driven analytics, strategy modeling, and real-time position management with institutional-grade advisory services, enabling professionals to confidently manage risk, capture yield, and deliver better outcomes.

Contact Us at info@volworks.com

©2025 Volworks

Comments